Partner London

"Cargo interests disputed liability for their share of the ransom payment."

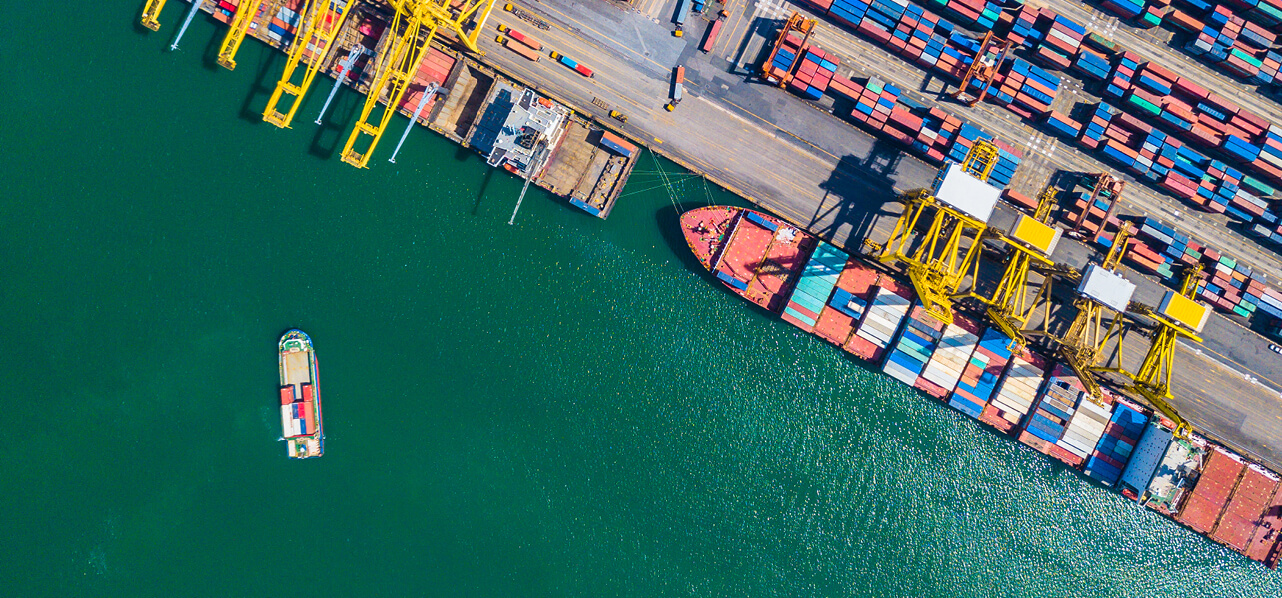

In a well-timed decision given the current situation in the Red Sea and Gulf of Aden, the UK Supreme Court recently handed down judgment in Herculito Maritime Ltd v Gunvor International BV [2024] UKSC 2, a decision that arose from seizure of a ship by Somali pirates.

Key facts

- The vessel MT Polar was chartered to carry a cargo of fuel oil from St Petersburg to Singapore. The most direct route would be via the Suez Canal and Gulf of Aden.

- The Gulf of Aden was within the “high risk area” for piracy when the charter was agreed. The charter included a Gulf of Aden clause and war risks clause, pursuant to which the owners took out additional kidnap and ransom insurance at the charterers’ expense.

- The issued bills of lading incorporated the charter terms and included clauses settling general average according to the York-Antwerp Rules.

- On 30 October 2010, Somali pirates seized the vessel whilst it was passing through the Gulf of Aden. The vessel was held captive for 10 months until it was released on 26 August 2011 in exchange for a ransom of US$7.7m, paid on behalf of the shipowner. The shipowner declared general average and the assessment determined that it was owed US$5,914,560.75 from cargo interests under the bills of lading. The majority component of that sum was the ransom.

- Cargo interests disputed liability for their share of the ransom payment on the basis that the shipowner’s only remedy was to recover the ransom under additional insurance which had been taken out to cover war risks and paid for by charterers.

Procedural history

"There was no insurance code or fund in the charter."

The procedural path of the dispute has not been straightforward. An arbitral tribunal initially found in cargo interests’ favour. However, the High Court disagreed with the tribunal on certain issues, with the result that cargo interests would have to contribute to general average. The Court of Appeal reached largely the same conclusion as the High Court, resulting in a further appeal by cargo interests to the Supreme Court.

Key legal issues

The key legal issues were:

- whether there was an insurance fund, such that the shipowner was unable to claim from the charterer for any losses that were covered by the additional insurance for which the charterers had paid the premium; and

- if such a fund existed, to what extent were such charter terms incorporated into the bills of lading?

The Supreme Court decision

The Supreme Court agreed with the Court of Appeal and held that there was no insurance code or fund in the charter. As a result, there was no fund that could correspondingly be incorporated into the bills of lading and therefore cargo interests were liable for the general average contributions. In reaching this conclusion, the judges confirmed unanimously the following key points:

"There is a high threshold level which must be met to establish that the code exists."

- it is a question of contract construction whether the parties have agreed an insurance code or fund (by which parties agree to look solely to insurers as the avenue of recourse and not to their contractual counterparty). Express words will not have been used. To establish that the parties have agreed an insurance code it has to be shown that this is a “necessary consequence” of what has been agreed;

- it is therefore similar to a necessarily implied term and so there is a high threshold level which must be met to establish that the code exists;

- leaving aside cases of joint insurance, the search for an insurance code in a charterparty necessarily introduces uncertainty;

- the existence of an implied insurance code will affect the insurers’ rights of subrogation and impact their rating of the risk. This may lead to difficulties with full and fair disclosure to insurers when the existence of such a code is uncertain;

- general average is a common law right, regulated by contract. For the shipowner to give up such a valuable right requires a clear agreement; and

- even if the insurance code existed and had been materially incorporated in the bills of lading, the wording could not be manipulated to give the “bill of lading holder” (the cargo interests) the benefit of that code.

Discussion

"Every charter will need to be considered on its own terms."

As well as the key legal issues highlighted above, the Supreme Court held that in charterparties containing an agreement to proceed via Suez and necessarily the Gulf of Aden/Red Sea, the shipowner cannot exercise general liberties to deviate and proceed around the Cape of Good Hope to avoid war risks unless there has been a qualitative change in circumstances from those at the start of the charter (the same principle would apply to other pre-agreed routes). This is of immediate significance in the context of attacks by the Houthi movement on commercial vessels in the Red Sea.

In practice, the majority of charterparties for ships presently in the Red Sea were operating before the outbreak of the current hostilities. This means that the shipowners may be able to rely on a change in the nature of the risk since the charter was concluded and have a right to deviate to avoid potential Houthi attacks. Of course, every charter will need to be considered on its own terms, taking account of the specific wording and context of the relevant clauses.

We are advising on a range of issues related to war risks and Red Sea transit. Please get in touch with the author or your usual WFW contact should you wish to discuss further.

Key contacts

Partner London

Senior Associate London