US$24bn Simandou, the world’s largest mining and related exit infrastructure project, on which Watson Farley & Williams (“WFW”) is advising the Republic of Guinea (“Guinea”), hit a major milestone last week with the signing of the core transaction documents. This follows the signing of the foundational term sheet on 22 December 2022.

The key signed agreements include:

- the JV agreement for the common infrastructure company (La Compagnie du Transguinéen) which aligns the interests of Guinea and its industrial partners (Simfer Jersey, a joint venture between Rio Tinto and a consortium led by China’s state-owned Chalco Iron Ore Holdings, and WCS, a consortium led by Winning Consortium);

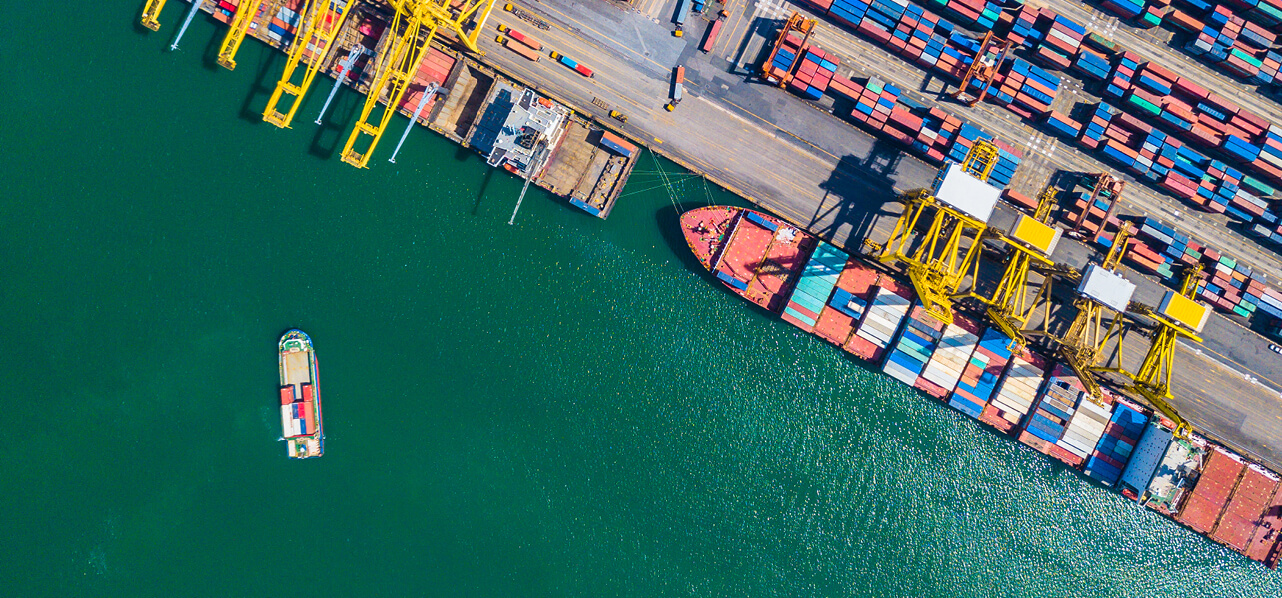

- the infrastructure co-development agreement relating to a 600km railway and a 160mtpa mineral port;

- the third-party access regime (and related multi-user, multi-purpose and tariff arrangements);

- the definition of a new tax regime; and

- amendments to the existing mining conventions of Simfer and WCS.

All these agreements also require the project to comply with the highest ESG standards.

The cross-border and multidisciplinary WFW team that advised Guinea was led by Dubai Projects Partner Alhassane Barry, working closely with London-based Global Mining & Commodities Sector Head Jan Mellmann, Paris Regulatory & Public Law Partner Arnaud Troizier, London ESG Partner Sarah Ellington, Paris Tax Partner Romain Girtanner, New York Tax and Regulatory Partner Daniel Pilarski, London Corporate Partner Chris Kilburn and Dubai Projects Partner Mhairi Main Garcia. They were supported in London by, Senior Associates David Bath (Corporate), Sarah Williamson (Corporate), Rhiannon Elias (Projects) and Valentina Keys (ESG), Associates Idil Yusuf (Corporate) and Philippa Beasley (ESG); in Paris by Counsel Hélène Ibos (Tax), Associates Simon Dumontel (Regulatory & Public Law) and Maximilian Cristescu (Tax); and in Dubai by Associates Youssef J. Fichtali and Amoetsoe Mkwena (Projects).

Alhassane and Jan commented: “This is undoubtedly a historic moment for this landmark mining and infrastructure project, and it has been our great privilege to help Guinea and its industrial partners to get to this stage. The complex negotiations have required coordinated and sophisticated expertise across a wide range of sectors and practices, including corporate and JV structuring, mining conventions, infrastructure concessions and BOT agreements, mining and infrastructure industry knowledge, tax, construction, shared infrastructure and third-party access regimes, ESG, competition, project financing and foreign direct investment. It is a testament to WFW’s unrivalled expertise in our core sectors across all key service lines that we were able to bring together such a strong global team to help progress such an important and complex project that will revolutionise Guinea’s economy and the lives of the Guinean people”.

Guinea’s financial and technical advisors were Global Sovereign Advisory (GSA), CPCS, EGIS and SETEC.

Its industrial partners were advised by a roster of top international law firms including Clifford Chance, Linklaters, Norton Rose Fulbright, Allens, Hogan Lovells, ADNA and Thiam & Associés.