Watson Farley & Williams (“WFW”) has advised certain lenders in connection with newly arranged secured term loan financings used to assist Navios Maritime Acquisition Corporation (“Navios Acquisition”) finance part of the redemption price of its outstanding 8.125% First Priority Ship Mortgage Notes.

Specifically, WFW acted for Hamburg Commercial Bank AG as mandated lead arranger, agent and security trustee, together with Alpha Bank S.A. as lenders in connection with a secured term loan facility of up to US$195m and BNP Paribas as agent and security trustee and together with Crédit Agricole Corporate and Investment Bank, both as mandated lead arrangers and lenders in connection with a loan facility of up to US$96m.

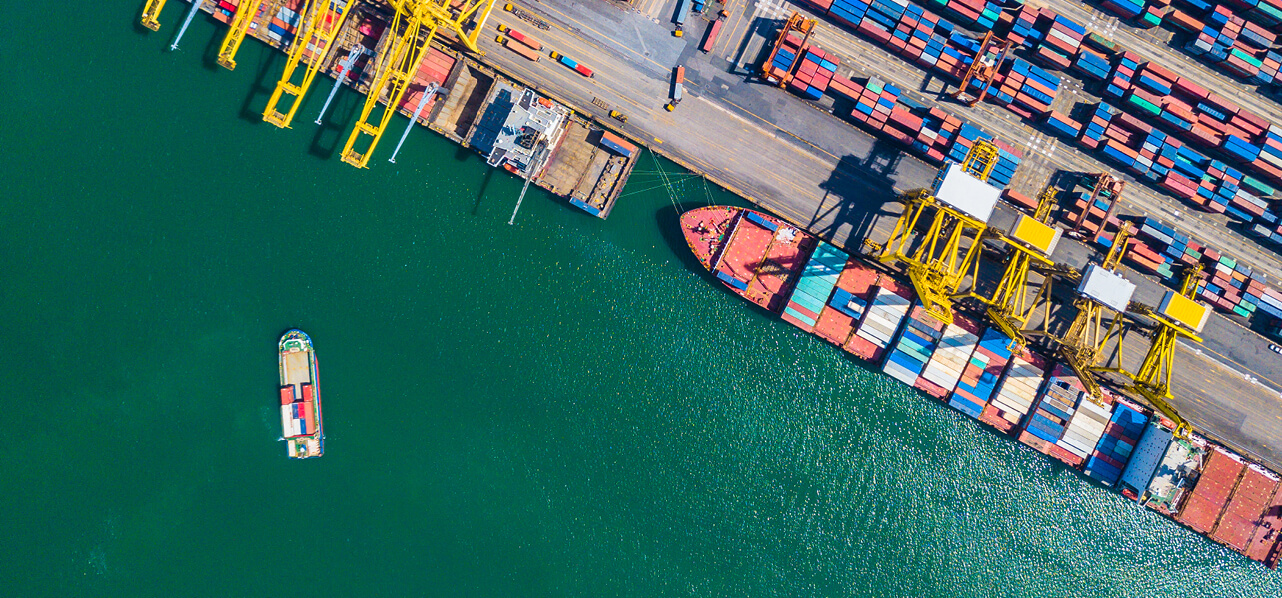

Navios Acquisition owns and operates a crude oil, refined petroleum product and chemical tanker fleet. It recently announced a definitive merger agreement with Navios Maritime Partners L.P. (“Navios Partners”), an owner and operator of dry cargo vessels. This is a transformative transaction for Navios Partners, as the combined entity will become the largest US publicly-listed shipping company in terms of vessel count, with the value of its united fleet of over 140 vessels being circa US$4.2bn. Pursuant to the definitive merger agreement, Navios Acquisition called for a redemption of all of its outstanding Ship Mortgage Notes.

The WFW Athens team that advised the banks was led by Partner and Global Maritime Sector Co-Head George Paleokrassas, supported by Senior Associate Christina Economides, Associate Haris Kazantzis and Trainee Katerina Dimitriou.

George commented: “We are delighted to have advised Hamburg Commercial Bank, BNP Paribas, Crédit Agricole Corporate, Investment Bank and Alpha Bank on this complex and high-profile transaction. This deal strengthens Navios Partners’ overall market position and enables the combined entity to achieve diversification and to mitigate segment volatility as operational segments are driven by unique fundamentals”.